Swing Trading Definition: Unlocking the Secrets of Effective Trading Strategies

Understanding Swing Trading

Swing trading is a popular trading strategy employed by traders and investors who aim to capture short to medium-term gains in a stock (or any financial asset). This approach takes advantage of price fluctuations that occur over a period of days or weeks. Unlike day trading, where the objective is to profit from intraday price movements, swing trading focuses on holding positions for longer durations, providing ample opportunities to profit from market movements. Understanding the swing trading definition is crucial for anyone looking to enhance their trading skills and navigate the financial markets effectively.

The Core Principles of Swing Trading

At its essence, swing trading is guided by several core principles that differentiate it from other trading methodologies. Here are the pivotal elements:

- Time Frame: Swing traders generally operate within a time frame of 1 to 14 days, allowing them to capture larger price movements.

- Market Psychology: Understanding market sentiment and psychology is crucial for swing traders as it influences price movements.

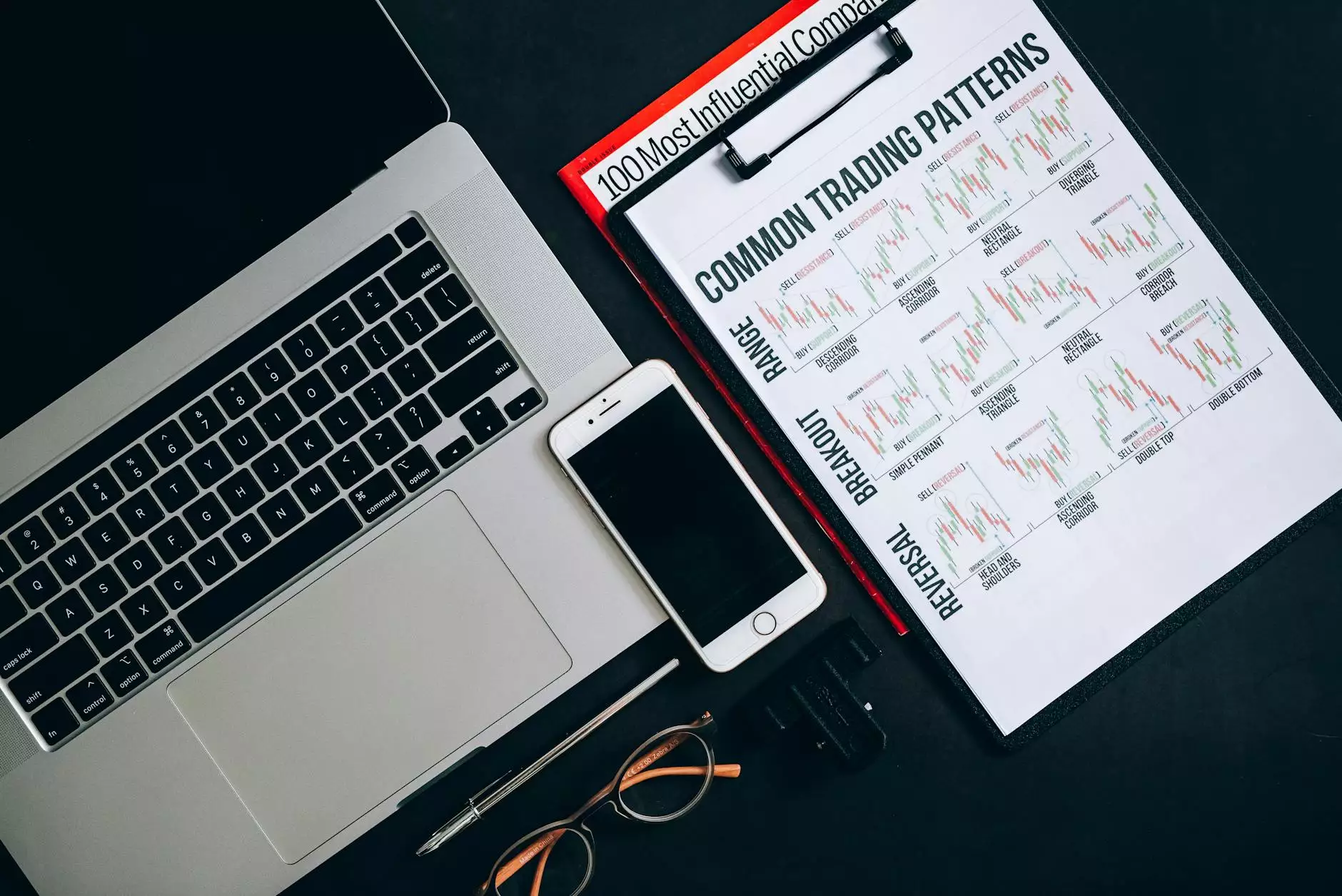

- Technical Analysis: Swing trading heavily relies on technical analysis to make informed trading decisions. This includes chart patterns, indicators, and historical price movements.

- Risk Management: Proper risk management strategies are essential for swing trading to protect capital and minimize losses.

- Trading Strategy: Having a well-defined trading strategy that includes entry and exit points is vital for success.

How Swing Trading Works

Now that we have established the swing trading definition, let’s delve deeper into how swing trading works in practice:

Identifying Opportunities

To begin swing trading, traders typically look for stocks (or assets) that show potential for price movements. This can be done through:

- Screening for stocks with high volatility.

- Analyzing charts for breakout patterns and setups.

- Looking for stocks with strong news catalysts that can drive price movements.

Executing Trades

Once a trader identifies a potential swing trade, they will set entry points (the price at which to buy) and exit points (the price at which to sell) based on their analysis. This typically includes:

- Utilizing stop-loss orders to minimize losses.

- Establishing profit targets to secure gains once the price reaches a favorable level.

Monitoring Positions

After executing a trade, it is essential for swing traders to monitor their open positions regularly. This involves:

- Adjusting stop-loss levels as the price moves in favor of the trade.

- Staying updated on market news and trends that could impact positions.

The Benefits of Swing Trading

Understanding the swing trading definition is just the beginning; realizing the benefits of this trading style can provide significant motivation:

Flexible Time Commitment

Compared to day trading, swing trading does not require constant monitoring of the markets. This makes it ideal for individuals who may have other commitments, such as a full-time job.

Potential for Significant Returns

Swing traders have the potential to achieve significant returns by capturing larger price movements over a few days or weeks compared to the smaller gains typically targeted in day trading.

Diverse Asset Classes

Swing trading is not limited to stocks; it can be applied to various asset classes, including forex, options, futures, and cryptocurrencies, providing traders with diverse opportunities to profit.

Challenges in Swing Trading

While swing trading offers various benefits, several challenges must be considered:

Market Volatility

Market volatility can lead to sudden price movements, which might result in unexpected losses if not managed effectively.

Emotional Management

Swing traders must maintain emotional discipline and avoid making irrational decisions based on market fluctuations.

Requires Continuous Learning

The financial markets are constantly changing, so swing traders need to stay informed and continually refine their strategies.

Best Strategies for Successful Swing Trading

To maximize the chances of success in swing trading, consider the following strategies:

Trend Following

Identifying and following trends can increase the probability of successful trades. Trade in the direction of the market trend, whether it’s bullish or bearish.

Breakout Trading

Breakout strategies involve identifying key resistance and support levels. Enter trades when prices break through these key thresholds.

Reversal Trading

Reversal strategies focus on identifying potential turning points in the market. Use technical indicators to predict reversals.

Using Technical Indicators

Leverage various technical indicators, such as the Relative Strength Index (RSI) and Moving Averages, to strengthen your trading decisions.

Essential Tools for Swing Traders

Equipped with the right tools can significantly enhance a swing trader's ability to analyze the market effectively:

- Trading Platforms: Utilize advanced trading platforms that provide real-time data and analysis tools.

- Charting Software: High-quality charting software is vital for performing technical analysis.

- News Aggregators: Stay updated with market news, earnings reports, and other relevant information that can impact trades.

- Risk Management Tools: Incorporate tools to analyze and manage risk effectively, such as position sizing calculators.

Conclusion: The Future of Swing Trading

In conclusion, understanding the swing trading definition and employing effective strategies can equip traders with the tools needed to navigate the financial markets with confidence. Whether you are engaged in IT Services & Computer Repair or Financial Advising under the umbrella of BullRush.com, embracing swing trading can diversify your investment approach and enhance your engagement with the stock market.

As you embark on your swing trading journey, remember that continuous learning and adaptation to market conditions are key. With the right knowledge and resources, you can position yourself for success in a dynamic trading landscape.